Warren Buffett's million dollar idea (#81)

The idea that Buffett learned as a young boy that set him on the path to becoming a millionaire

There are really only two things I want to know when I read about a billionaire:

How do they think differently?

How did they start?

It’s fine, for example, to learn about how Mark Cuban came up with the idea for internet broadcasting, started AudioNet (later Braodcast.com), and sold it to Yahoo! in four years for $5.7 billion. But his origin is more interesting: from a 20-something unemployed salesperson to selling his first company, MicroSolutions seven years later for $6 million. That’s something we can relate to. What got him there?

It’s the same with Warren Buffett.

Many hear about his moves as a billionaire—putting a ton of money into Coke or Apple or something. Maybe you’ve even read some of his shareholder letters. But what about how he made his first million dollars? How did a middle-ish class Nebraskan, born in the height of the depression, get from zero to something?

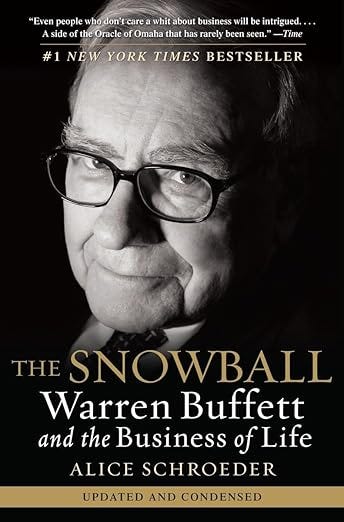

In the first half of The Snowball: Warren Buffett and the Business of Life, Alice Shroeder provides the answers. She shows how Buffett, at the age of 10, read a book that changed his way of seeing money, and set him off on a chain of events. And how it was this concept that set Buffett on a direct path to becoming a millionaire.

It’s that event that is the subject of today’s OGT.

One day, down at the Benson Library, a book beckoned from the shelves.

Its shiny silver cover gleamed like a heap of coins, hinting at the value of its contents. Captivated by the title, he opened it and was immediately hooked.

One Thousand Ways to Make $1,000, it was called. A million dollars, in other words!"

There were plenty of concepts in it’s 400+ pages that spoke to Buffett, but two were most important.

The first lesson was jarring. It had all of these way to make money, but it made sure to hammer home this one point: start.

“But,” the book cautioned, “you cannot possibly succeed until you start.

The way to begin making money is to begin.… Hundreds of thousands of people in this country who would like to make a lot of money are not making it because they are waiting for this, that, or the other to happen.”

Begin it! the book admonished..

That first point motivated Buffett to begin—and he did.

Over the next decade, Buffett would start a handful of businesses. The most successful of which was a pinball machine business, which earned him over $5,000 when he was 17—the equivalent of ~$70k now.

But the second lesson turned his mind around. It changed how he thought about money. And, more importantly, how easy it was to make.

The idea that captivated Warren was pennyweight scales. If he had a weighing machine, he would weigh himself fifty times a day. He was sure that other people would pay money to do that too.

“The weighing machine was easy to understand. I’d buy a weighing machine and use the profits to buy more weighing machines. Pretty soon I’d have twenty weighing machines, and everybody would weigh themselves fifty times a day. I thought—that’s where the money is. The compounding of it—what could be better than that?”

This concept—compounding—struck him as critically important. The book said he could make a thousand dollars. If he started with a thousand dollars and grew it ten percent a year:

In five years, $1,000 became more than $1,600.

In ten years, it became almost $2,600.

In twenty-five years, it became more than $10,800.

The way that numbers exploded as they grew at a constant rate over time was how a small sum could turn into a fortune. He could picture the numbers compounding as vividly as the way a snowball grew when he rolled it across the lawn.

Warren began to think about time in a different way. Compounding married the present to the future. If a dollar today was going to be worth ten some years from now, then in his mind the two were the same.

That was the idea that changed everything for Buffett. It was that any money was inherently worth a lot more money. All you needed was money and a vehicle for it, and since time was a constant, riches was a virtual lock.

This created possibility for Buffett, and it made his next goal obvious: get the money.

Sitting on the stoop at his friend Stu Erickson’s, Warren announced that he would be a millionaire by the time he reached age thirty-five. That was an audacious, almost silly-sounding statement for a child to make in the depressed world of 1941. But his calculations—and the book—said it was possible.

He had twenty-five years, and he needed more money. Still, he was sure he could do it. The more money he collected early on, the longer the money could compound, and the better his chances of achieving his goal.

It worked, by the way—and faster than he’d predicted.

Buffett became a millionaire in 1961.

He was 30.

The OGT: no accidental billionaires

When I read this chapter of the book, I thought instantly of Maxim Magazine founder, Felix Dennis.

In Dennis’s book, How To Get Rich—the subject of another OGT— he makes a claim in near the start: that there are no accidental billionaires.

Dennis, a billionaire, admitted that there is, of course, tons of luck involved. But, if people are billionaires, he says, you can be sure of this—it was 100% their single-minded, maniacal intention, and there were no exceptions.

What we can take, I think, are the products or causes of that focused thought. It typically produces—or was produced by—different ways of seeing the world. Ray Dalio’s view of himself as a machine, for instance. Or Cuban’s unrelenting focus on sales.

One idea we should take from Buffett is the idea he took from this book. That small amounts of money and large amounts are the same thing. The only thing that separates them are time—but time is a constant. It means that for those who don’t blow the money, and who have the patience to wait, money will multiply.

It’s funny, then, if you put the two ideas together. Begin now, is lesson one from One Thousand Ways.

But lesson two is: now wait a while.